The auto industry employs 59 million people globally, either directly or indirectly, and contributes an estimated $5.5 trillion to the global economy. Since its inception, the industry has grown in importance to the global economy, so much so that it now causes ripple effects through other industries when it slows. Put another way, the world has a vested interest in keeping the industry rolling.

But to avoid falling behind industry innovations, automotive-related businesses should pay close attention to key trends and make the necessary adjustments now.

Auto Manufacturers

Low-margin electric vehicles are struggling to grow beyond 2% of the U.S. market. In response, Bloomberg Intelligence expects automakers to, at least temporarily, demphasize electric vehicles and promote dependable highmargin trucks. This bodes well for Indiana, which builds the Chevrolet Silverado and GMC Sierra at the Fort Wayne Assembly plant in Roanoke, Ind.

Taking the long view, the COVID-19 pandemic is a mere pothole in the automotive industry’s road toward electronic innovations. Auto manufacturers and their suppliers would be smart to continue shifting their focus toward hybrid-vehicle technology, which is expected to account for 18.9%of North American production volume by 2025. That’s up a percentage point from preCOVID-19 forecasts, according to London-based auto industry analytics firm IHS Markit.

Auto Suppliers

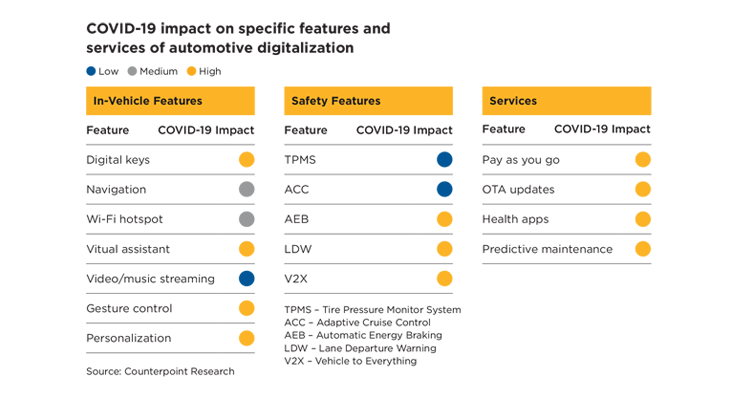

That push toward electronification is encompassing not only how the car is powered, but also the driver experience, with a focus on luxury and digital upgrades. As the virus pushes people toward a more digital lifestyle, buyers will place a greater emphasis on digital safety, tracking and efficiency. And with the rapid adoption of 5G technology, expect consumers to demand more screens in their cars to further propel the digitalization trend.

Given the time it takes to bring new technology to market, auto suppliers must work to stay years ahead of current consumer demand. This means keeping the focus on a digital and autonomous future. The sensor and service elements are popular now, but they will only grow in importance and become essential in electronic and autonomous vehicles.

In the next five years, the compound annual growth rate in the global automotive sensor market is expected to jump 10.5%, from $24.5 billion in 2020 to $40.3 billion in 2025.

Auto Dealers

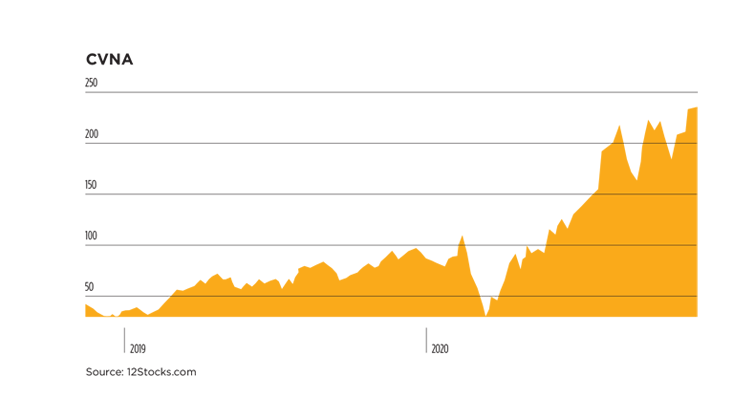

Online automobile retailers are best positioned, at least immediately, for the new

post-COVID-19 shopping experience. Consumers have already come to expect a touchless, socially distant experience in all facets of their daily lives, and they’ll expect the same considerations during their next vehicle purchase. Online retailers like Vroom and Carvana have perfected their selling format and may have a head start over traditional auto dealers who are now trying to shift gears; Bloomberg Intelligence expects 23% year-over-year growth for Carvana.

READ THE FULL STORY >